MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Looking for more options?

Check out Best Business Employee Retirement Plans of 2024 business.com recommends.

Table of Contents

Human Interest keeps expenses down for employers and employees, offering low-cost employee retirement plans with a lot of features and functionality. When you work with Human Interest, you can get affordable full-service retirement plans for your team.

- Human Interest keeps the costs for its retirement plans low, which is essential for small businesses on a budget.

- The vendor offers a full suite of services for an affordable price, including plan administration, employee onboarding and support, and concierge-style customer service if needed.

- It takes just three minutes to set up a compliant 401(k) plan with Human Interest.

- Human Interest charges a one-time sign-on fee of $499, though you can often get it waived.

- The company takes a no-touch digital approach to setting up and managing employee retirement plans, which could turn off less tech-savvy business owners.

business.com

Looking for more options?

Check out Best Business Employee Retirement Plans of 2024 business.com recommends.

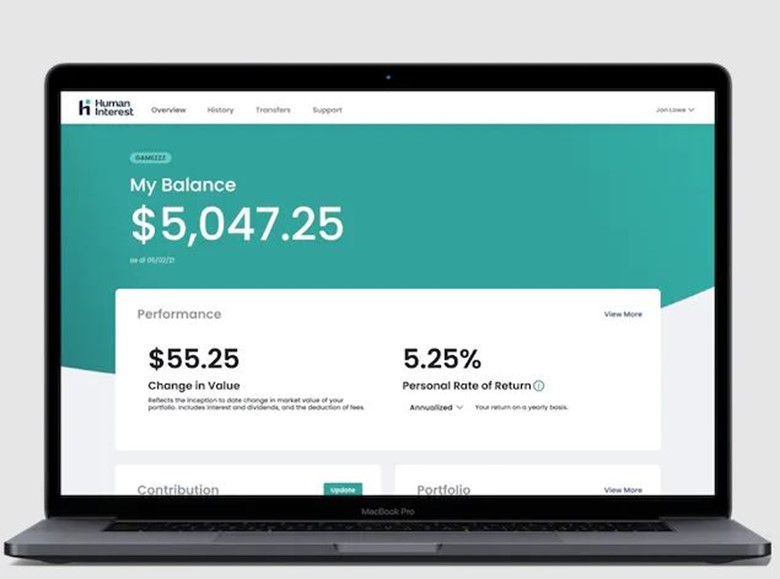

Small business owners know they should offer their staff employee retirement plans to stay competitive, but many don’t think they can afford it. What they fail to realize is there are low-cost plans out there for smaller enterprises. These plan providers make it possible for all small business owners and their employees to save for retirement. Human Interest is a standout example, as this vendor keeps prices low by taking a digital approach to enrolling and managing your retirement plans.

But that’s not the only reason this company is our best pick for business owners prioritizing affordability when searching for an employee retirement plan administrator. When you work with Human Interest, you get lots of tools and functionality for an inexpensive price, including integrations with more than 400 payroll providers, automated administration and recordkeeping. Plus, if you want Human Interest to procure your ERISA bond, act as your plan administrator and fiduciary and sign and file your IRS documents, this plan provider won’t add massive fees to your overall costs.

Human Interest Editor's Rating:

9.3 / 10

- Transparent pricing

- 10/10

- Low employee investment fees

- 9.5/10

- Mobile and online access

- 10/10

- No sign-up or administration fees

- 8/10

- Variety of plans

- 9/10

Why We Chose Human Interest as Best for Affordability

In a tight labor market, employers can’t afford not to offer an employee retirement savings plan. But that doesn’t mean such a benefit has to break your bank. Human Interest sets itself apart from other plan providers by facilitating an appealing Essentials plan that costs only $120 a month and $4 per employee. For that price, you can integrate employee retirement plan data with over 400 payroll providers, create custom retirement plans, and automate plan administration and recordkeeping.

Keeping costs low, Human Interest charges just $150 per month — plus $6 per employee, per month — to act as your retirement plan administrator and fiduciary. If you need a dedicated manager, go with the still-inexpensive Concierge plan at $180 a month, plus $8 per employee. For comparison, we found in our review of USA 401k that this Human Interest rival charges a one-time $250 installation fee, a $500 annual fee and $20 per plan participant, per month. In contrast, Human Interest only has a $499 installation fee that it often waives as part of ongoing promotions.

We also like the vendor’s low investment fees for employees. At 0.50 percent, Human Interest’s fee is well below the industry average of 1.65 percent. That’s important because fees can eat away at returns over an employee’s lifetime. With all this in mind, partnering with Human Interest is usually cheaper than competitors.

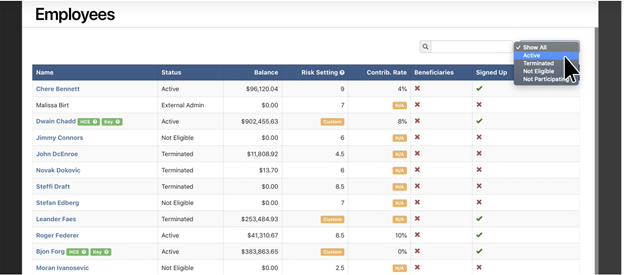

Human Interest makes it easy to manage employee contributions with a user-friendly dashboard. Source: Human Interest

A retirement plan provider also has to offer a lot of helpful features and functionality at a reasonable price point for you to truly get the most bang for your buck. Human Interest checks those boxes for us as well. As an example, take its concierge-style approach to setting up your employee retirement plans. You’ll work with a team of specialists to create custom plans that meet your business’s specific needs.

Human Interest can also act as your plan administrator, offers payroll integration and contribution processing, provides all required disclosures and allows employees to take loans from their retirement accounts. We also like how Human Interest empowers employees with access to mobile enrollment, Morningstar Snapshot Reports and online retirement and investment calculators. Price alone doesn’t make a retirement plan company affordable. It’s the services you get for that price that matters most. Human Interest delivers on both fronts, which is why we selected it as the best employee retirement plan provider for affordability.

When determining the best employee retirement plans, we paid close attention to what employees may pay in investment fees. This is a critical factor to consider when choosing a plan sponsor. The higher the fees, the less money goes to your employees and their retirement.

Ease of Use

The Human Interest software’s ability to integrate with more than 400 payroll programs is key to the system’s time-saving automation features. We like how employee and employer contribution rates are automatically updated, deducted and invested with the payroll integration enabled, removing opportunities for accounting errors. Human Interest also handles all account setup, recordkeeping and reporting, and updates of employee information. This allows business owners to be rather hands off.

Still, even with a digital-focused service, we were impressed with the personalized assistance you can receive if you need additional support. Human Interest provides businesses with a dedicated account manager when setting up and implementing retirement plans to ensure the process goes smoothly. We also like how Human Interest leads with technology. This cutting-edge approach keeps costs down and streamlines the process of implementing and managing an employee retirement plan for your staff.

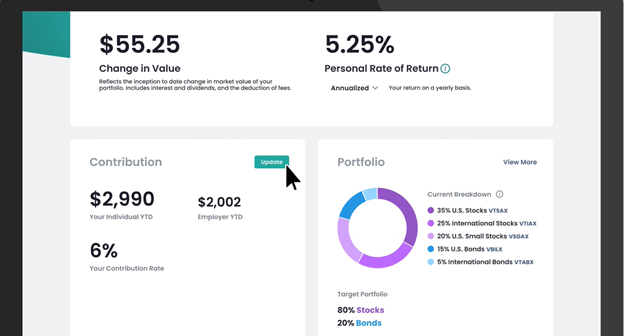

It’s simple for you and your employees to manage retirement savings plans online through Human Interest’s digital interface. Source: Human Interest

Features and Services

Human Interest is a full-service retirement plan sponsor, which means it offers a host of retirement savings features and services to small business owners. The best part? With Human Interest, you don’t have to sacrifice certain functions to keep this benefit affordable for you and your employees.

Employees can use the Human Interest portal to check their retirement account balance at any time. Source: Human Interest

Fiduciary Support

Human Interest can act as your plan administrator, custodian, recordkeeper and ERISA 3(38) investment manager. This takes vital tasks off your plate and leaves them to the experts.

Payroll Integration

Human Interest integrates with more than 400 top payroll companies to streamline plan enrollment, deductions and records. Some of the well-known integration options are Gusto, Rippling and QuickBooks Online. If, by chance, your payroll provider isn’t already partnered with Human Interest, the company wants you to let them know so they can potentially get the vendor on board — though they can still help you set up your retirement plan offerings regardless. Human Interest can also refer you to a new payroll partner. [See our Gusto payroll review to learn about the HR company’s add-ons and integrations, including employee retirement services.]

Investment Options

Plan participants work with Human Interest to create a portfolio of low-cost mutual funds. We like how these portfolios are rebalanced quarterly. Alternatively, employees can select and manage funds on their own. Enrolled team members have access to almost every mutual fund and index fund on the market, including Vanguard, Dimensional Fund Advisors, BlackRock and Charles Schwab.

Fund Research Tools

We were impressed by the ability to view Human Interest’s roster of exchange-traded funds and managed portfolios on the company’s website. Each fund featured on the site is linked to a Morningstar profile with information about the fund’s strategy, historical performance, asset allocation and other relevant details. The vendor also has educational information about investing on its site. All this information at your fingertips is an immense value-add when making investment choices.

To save for your own retirement as an entrepreneur, you may want to consider a traditional or Roth IRA.

Advisory Services

Human Interest works with financial advisers around the country to create custom retirement plans based on your business’s specific needs and the plan options you want to offer your workforce.

Reporting

Human Interest prepares all the necessary forms and disclosures you need when providing employee retirement plans. This is another example of how the plan provider reduces your personal workload so retirement plan administration isn’t just one more task on your already-long to-do list.

Loans

Human Interest includes loan and hardship withdrawal options in its 401(k) plans by default. This gives your team members the opportunity to borrow or withdraw money from their retirement savings account if needed.

Mobile App

Human Interest offers a mobile app for easy enrollment and plan management, which is notable because not all retirement plan providers support mobile access. For instance, our review of ShareBuilder 401k found that the rival company doesn’t have a mobile app for its users.

A small business 401(k) retirement plan is great to offer, but you have to get employees to participate for the benefit to be worthwhile. A mobile app and digital onboarding make plan setup easy for employees and tend to boost enrollment.

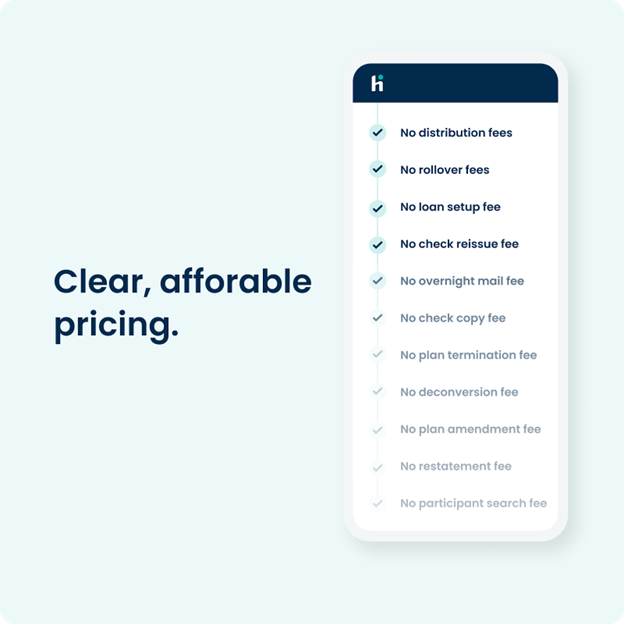

Pricing

Human Interest strives to offer affordable plans with three low-cost pricing tiers business owners can choose from.

| Plan | Cost | Services |

|---|---|---|

| Essentials | $120 per month, plus $4 per employee, per month | Integration with 400+ payroll providers, flexible plan design, automated administration and recordkeeping |

| Complete | $150 per month, plus $6 per employee, per month | Everything in the Essentials package, plus ERISA bond procurement, plan administration, 3(16) fiduciary, IRS document signing and filing |

| Concierge | $180 per month, plus $8 per employee, per month | Everything in the Complete package, plus dedicated account management |

Knowing that Human Interest charges a one-time $499 installation fee is alarming at first, but it’s reassuring that the company often waives this cost. The vendor also keeps prices down for your employees by only charging a 0.50 percent asset fee each year.

Human Interest is transparent and upfront about its lack of transaction fees and other charges that can make employee retirement plans more expensive for business owners to offer. Source: Human Interest

Implementation/Onboarding

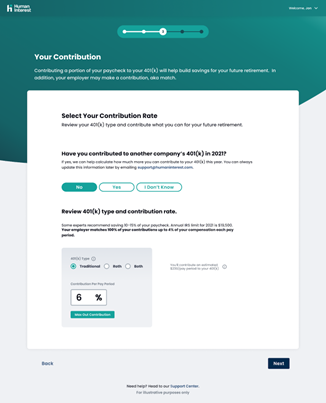

Human Interest is designed for easy implementation with a user-friendly digital platform. Thanks to an intuitive online onboarding questionnaire, business owners can establish a retirement plan for their staffers in as little as three minutes. For business owners with a lot of questions or concerns, one of the company’s onboarding specialists can assist you with the setup process. Employees are also supported as they set up their accounts, with a clear step-by-step process that should eliminate any concerns your workers have about the difficulty of signing up for the plan.

The onboarding process clearly outlines how an employee can set up their contribution rate. Source: Human Interest

Customer Service

Human Interest offers employers and employees customer service by phone at 855-622-7824, Monday through Friday, from 9 a.m. to 8 p.m. ET. You can also take advantage of email support by sending a message to support@humaninterest.com, or utilizing a contact form on the vendor’s website.

For those interested in self-service options, the Human Interest site boasts a robust “Support Center,” as well as a comprehensive “Learning Center.” Both databases are filled with valuable information, from practical tips on using the Human Interest platform to educational material on the different types of retirement plans. Users can access FAQs, review a glossary of retirement terms, stay up to date on relevant retirement legislation and even sign up for Human Interest’s “Retirement Roadmap” newsletter.

Limitations

Human Interest offers small businesses access to affordable employee retirement plans with tons of features and services, but it does have some potential drawbacks. One is its $499 installation fee. While a one-time sign-up fee is normal in this industry, we’d prefer it to be lower. However, the company does waive this fee when running promotions, so it can’t hurt to ask if you can have it waived when speaking with a sales representative.

Another possible downside is Human Interest’s near-total reliance on digital operations. While going paperless is more common with each passing year, not all business owners are tech-savvy and some prefer to deal with physical documentation for payroll and other financial matters. If that’s you, Human Interest may not be the right retirement plan provider for your company. However, this limitation will likely be seen as an advantage by those business owners who appreciate doing everything online.

Bottom Line: Small business owners have to stay competitive to recruit and retain top talent, and a retirement plan is one way to do that. Human Interest is a low-cost retirement plan provider that packs a lot of features and services into its inexpensive packages. Its digital-first approach, personalized support when necessary, and wide array of investment options make it the best retirement plan option for business owners concerned about affordability.

Methodology

When searching for the top retirement plan providers, we researched and analyzed different vendors to compare and contrast each administrator’s features, available plan types, pricing, integrations, customer support options and more. To find the best plan sponsor for business owners seeking the most affordable employee retirement plans, we started by homing in on the vendors that keep prices relatively low.

After identifying those companies, we dug into how much they charge for setup, in annual or monthly maintenance fees, and per employee, per month for their retirement plans and administration. We also looked into how much the plan sponsors charge employees for their investments. From there, we evaluated the breadth of features and services these affordable plan providers offer. We sought access to many investment options, a mobile and/or online app and top-notch customer service. After all, to be truly affordable and worth it, you have to offer a great plan at a low cost.

FAQs

Yes. Human Interest is a full-service employee retirement plan sponsor that offers 401(k) plans to small businesses, including safe harbor 401(k)s and traditional 401(k)s.

Human Interest, like many of its peers, charges a one-time installation fee in exchange for getting your business’s employee retirement plan system up and running. However, the vendor often waives this cost.

Bottom Line

We recommend Human Interest for …

- Small business owners who want an affordable employee retirement plan but don’t want to give up valuable features and services.

- Business owners who like a digital-first approach to implementing and managing employee retirement plans.

- Small business owners who need guidance from a team of retirement experts.

We don’t recommend Human Interest for …

- Small businesses that don’t use a digital payroll system.

- Business owners who don’t like the idea of or have the budget for a large installation fee.

business.com

Looking for more options?

Check out Best Business Employee Retirement Plans of 2024 business.com recommends.