MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Looking for more options?

Check out The Best Accounting and Invoice-Generating Software for 2024 business.com recommends.

Sage 50 Review and Pricing

Table of Contents

Sage 50 Accounting is our choice for the best desktop accounting software. This desktop solution with cloud connectivity is simple to set up and use while facilitating essential accounting tasks for small businesses.

- Businesses can create customized solutions through Sage’s open API.

- Sage is less expensive than many other accounting software applications we reviewed.

- Sage maintains an active community forum so you can get help from experts and fellow users.

- Sage doesn’t have the option to create recurring invoices, which may be inconvenient if you offer subscription products or services.

- You can’t schedule automatic payment reminders with Sage.

- Sage doesn’t let you track billable hours and add billable expenses.

business.com

Looking for more options?

Check out The Best Accounting and Invoice-Generating Software for 2024 business.com recommends.

Once a business launches, few things are more critical than accounting and financial management. Sage 50 Accounting provides business owners with all the small business accounting tools needed for financial tracking. This desktop-based software features cloud connectivity, so you can work offline while retaining the option to view your data remotely via the cloud. Additionally, because most small business owners aren’t accountants or bookkeepers, we appreciate that Sage is intuitive, easy to set up and use and provides robust customer support.

Sage 50 Editor's Rating:

8.7 / 10

- Payments

- 9.0/10

- Automatic invoicing

- 8.5/10

- Third-party integrations

- 8.5/10

- Mobile app

- 9.0/10

- 24/7 customer support

- 8.5/10

Why We Chose Sage 50 Accounting as Best for Desktop Users

While cloud-based accounting software offers flexibility and accessibility, desktop-based programs provide some advantages. Because the software resides on your local computer, you have complete control over data storage and security. Additionally, desktop software may run faster and require no internet connection, allowing uninterrupted work even during internet outages.

Sage is one of the few accounting software providers that still offers a desktop-based program. Its hybrid solution, Sage 50 Accounting, runs on a desktop but also connects to the cloud for remote access. The program includes many fundamental accounting software features, including bookkeeping, inventory management, real-time reporting and more. For these reasons, Sage is our top recommendation for desktop users seeking well-featured accounting software.

Sage 50 Accounting is a great alternative to QuickBooks, which also offers a desktop-based accounting program.

Sage helps businesses take control of their finances with automation, customized solutions and remote access. Source: Sage

Pros

- Business owners can install the Sage 50 Accounting software easily on their desktop computers.

- Sage boasts full integration with Microsoft 365.

- Sage maintains an active community forum so that you can get help from experts and fellow users.

Cons

- Sage 50 Accounting’s user interface (UI) is less modern than other accounting software programs we reviewed.

- The monthly price point is higher than competing, fully cloud-based software.

- Sage offers fewer integrations than QuickBooks and Xero.

Ease of Use

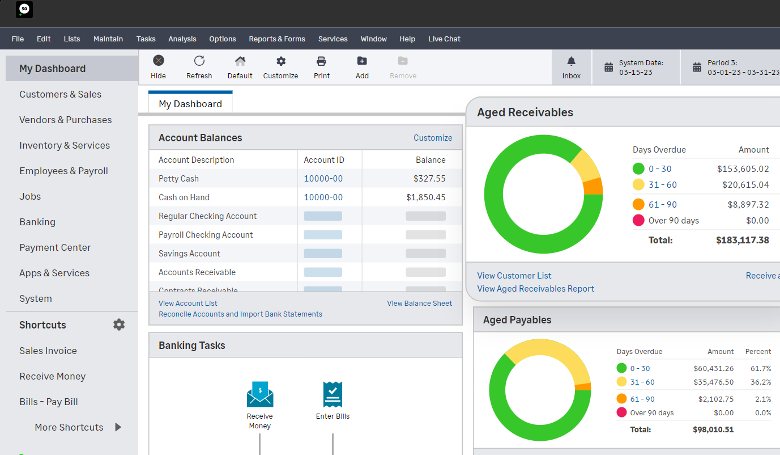

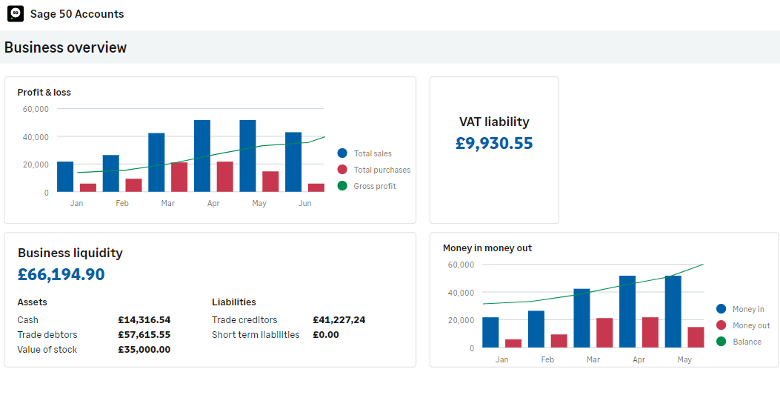

During our testing process, we found Sage 50 Accounting relatively straightforward to learn. Although the UI is a bit dated compared to alternatives, such as QuickBooks, Sage’s dashboard is easy to navigate and displays vital business statistics, such as liquidity, profit and loss and cash flow in real time. A live feed from your bank account allows you to see how money is flowing in and out of your business and you can generate reports automatically based on these key statistics. A drop-down menu at the top of the screen shows analysis, reports and more options.

We like that you can customize Sage’s dashboard according to your preferences and configure it to show areas of the business you or your employees deal with regularly. For example, you can customize the dashboard for an accounts receivable (AR) manager to display things like customer lists and invoices. This flexibility is great if you plan to have users with different roles using the program.

Sage’s main dashboard shows key business statistics. Source: Sage

Features

Sage 50 Accounting offers a wide range of valuable features without requiring a cloud-based setup. When testing the software, these were the desktop tools and functions that stood out the most to us.

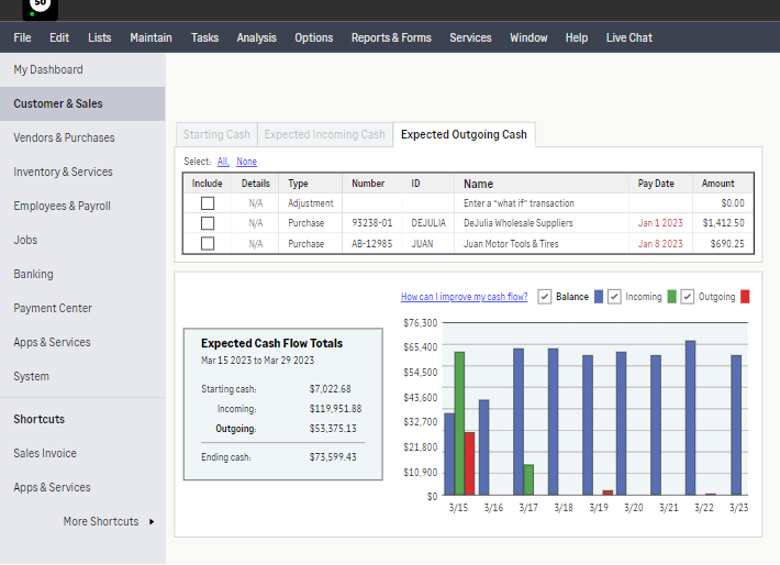

Cash flow management

Sage shines in providing easy access to tools and reports that help you manage your business’s cash flow. The software includes a what-if analysis to help you project cash flow as well as detailed breakdowns of how cash is flowing in and out of your business. We like that the program also shows what you’re owed and bills you need to pay so you can keep on top of near-term cash needs.

Sage emphasizes tools for controlling your cash flow. Source: Sage

Bank reconciliation

Reconciling a business bank account is tedious, but Sage allows you to automate this crucial accounting task. When you connect your business checking account, credit card accounts and business savings account to the Sage 50 Accounting software, the system downloads your transactions automatically. Its smart bank reconciliation tool matches your bank transactions to those you’ve created in the software automatically. This allows you to see if your accounts are cleared or if you have any remaining unreconciled differences.

Keeping business and personal accounts separate is crucial, even though many entrepreneurs self-fund their businesses.

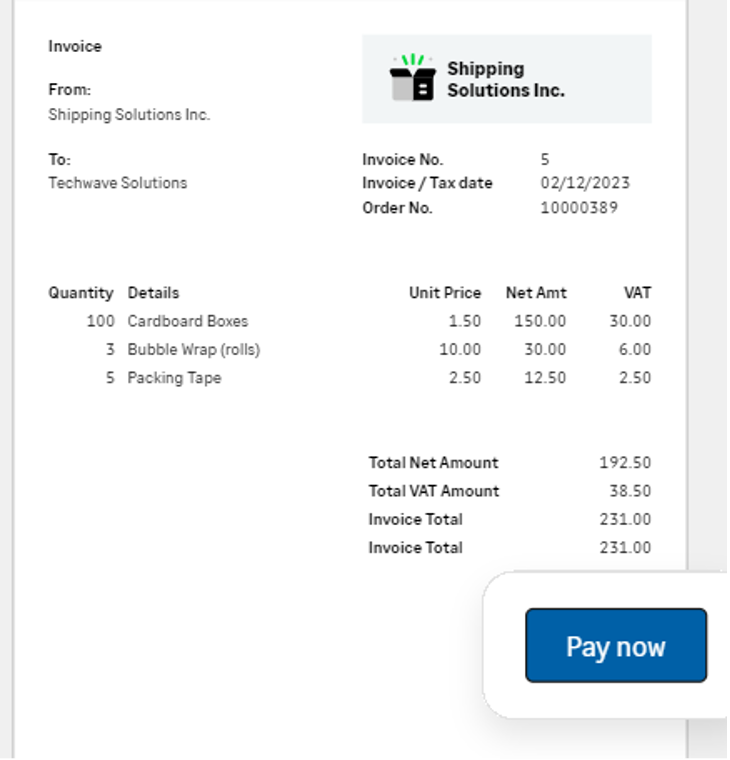

Invoices

A professional-looking small business invoice is critical to getting paid, so we appreciate that Sage offers an invoicing feature that makes it easy to bill customers. The invoicing tools include automatic payment reminders as well as integrations with Stripe, GoCardless and PayPal to streamline payment acceptance. [See our review of Stripe for more information.]

Sage 50 Accounting makes it fast and easy to create and send invoices from a computer or mobile device. Source: Sage

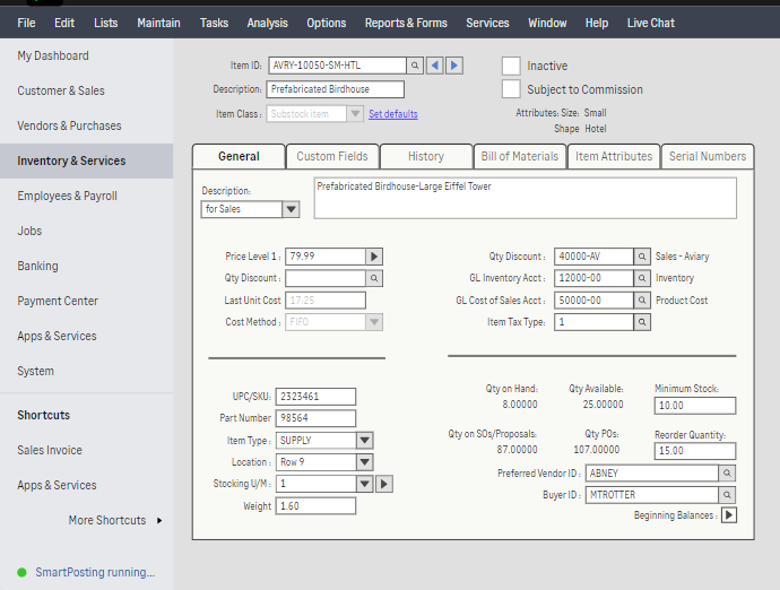

Inventory

We liked Sage’s inventory-tracking features, which can be incredibly helpful to businesses that sell tangible products. Set reorder quantities and adjust stock quantities manually as needed. You can enter items into the system manually or import them in bulk with a spreadsheet ― a time-saver if you carry many items or customized products. Sage also lets you set multiple prices for each item and add categories and descriptions.

You can view quantities in stock and purchase orders using Sage’s inventory management tools. Source: Sage

If your business has complex inventory needs, consider using one of the top point-of-sale (POS) systems that can sync inventory automatically, create product variations and bundles and issue low-stock alerts.

Financial reporting

Organized financial reports make it easier to leverage your business’s data and generate insights about what’s going on under the hood, financially speaking. When we tried Sage 50 Accounting, we were impressed that Sage offers 150 real-time financial reports to analyze your business’s financial health. These reports include profit and loss statements, balance sheets, trial balance reports, general ledger reports and AR aging. We like that reports can be customized using Sage’s prebuilt options as a starting point.

Integrations

Recently, Sage expanded its built-in integrations significantly. While still limited compared to rivals, we like that the Sage Marketplace now boasts nearly 200 apps with built-in syncing, including POS systems and customer relationship management software. Sage also offers add-ons for Sage Payroll as well as Microsoft 365. With the Microsoft integration, you get access to financial reporting in Excel and cloud backups of all your data.

If you’re interested in an accounting software solution with a seemingly endless amount of integration possibilities, check out our review of Xero. Xero integrates with more than 1,000 third-party business apps ― among the most of any accounting software package we reviewed.

Expense control

One unique feature we noticed when testing Sage 50 Accounting is its “Jobs” tab, which allows you to assign unique records, phrases and cost codes to your business’s jobs. Business owners can then track job costs through purchasing, inventory adjustment, payroll and more. Using Sage’s analytics, you can pinpoint which projects generate the most revenue for your business and you can also customize the job status and contact fields. We think cost-conscious business owners will find a lot to like with this tool.

Pricing

Sage sells three plans for its Sage 50 Accounting software with subscriptions paid on either a monthly or annual basis:

- Pro Accounting: The entry-level plan costs $58.92 a month and is marketed toward solopreneurs. It includes access for one user, along with invoicing, purchase order/approval, expense management, bank reconciliation, reports, inventory management, job cost control and more.

- Premium Accounting: This more advanced offering costs $96.58 to $222.25, depending on the number of users (up to five). It’s geared toward small businesses and includes everything in the Pro plan, plus support for multiple companies, advanced budgeting tools and reports, audit trails and industry-specific functionality.

- Quantum Accounting: Sage’s highest offering costs $160 to $409-plus per month, depending on the number of users (up to 10, although you can obtain a custom quote from the vendor for additional users). It includes everything in the Premium plan, plus role-based user permissions and workflow management.

Beyond these three paid plans, Sage also offers bundles with its payroll software priced starting at $993 annually. Optional paid add-ons include AutoEntry for document data, prepaid check ordering and payments through Stripe and PayPal.

Implementation/Onboarding

While what we most appreciate about Sage 50 Accounting is its offline desktop usability, we like that Sage offers a free, cloud-based trial called “Test Drive.” Although this trial version of the software isn’t full-featured, it doesn’t require a credit card for sign-up and should give you a solid idea of the program’s capabilities. You can speak with a sales representative by phone for more personal guidance as you try the product.

When you’re ready to fully implement the software, we love that Sage provides step-by-step instructions for migrating your existing accounting data to the Sage 50 Accounting system, creating a seamless transition for users switching from another accounting platform. If you need further assistance while setting up the program, Sage University is a great resource during onboarding and beyond — learn more about it below.

Customer Support

Many software providers skimp on customer service, but we were impressed by Sage’s many customer support resources:

- Sage City: We especially like this online forum — a 24/7 interactive community where you can talk with peers, partners, Sage experts and other users about issues, tips and ideas. On Sage City, you can share questions and problems and receive responses from Sage’s support team as well as fellow users. There is also a developer forum specifically for those creating software integrations.

- Online reference materials: All the vendor’s product reference materials and guides are available through the Sage knowledge base.

- Sage University: Sage University offers training courses to help small business owners get the most out of the software. These online classes give you a comprehensive understanding of the program and provide general advice for running a business.

- One-on-one support: If you prefer to speak with an expert directly, Sage lets you chat with customer support agents Monday through Friday, from 9:30 a.m. to 5:30 p.m. Eastern time. You can also schedule a one-on-one session through Sage 50 Expert Services.

Even though hands-on support isn’t available 24/7, Sage still earns a score of 4.3 out of 5 on Trustpilot for customer service.

Limitations

Although Sage 50 Accounting has many advantages for users who want a desktop accounting solution, we found a few drawbacks in the entry-level version of the software:

- Higher prices: Sage is more expensive on a monthly basis than pure cloud-based software, such as QuickBooks, Xero and FreshBooks. [See our FreshBooks review to compare prices.]

- Dated UI: During our testing, we found Sage 50 Accounting’s UI rather dated compared with other accounting software programs we evaluated. However, this may be an intentional strategy to keep the software familiar for longtime users who may dislike needing to learn new formats.

- Fewer integrations: Sage offers nearly 200 integrations, which puts it in the middle of the pack for accounting software. Other leading accounting services, such as QuickBooks and Xero, boast more than 700 integrations each.

Tech-savvy business owners should also read our review of Zoho Books to learn about a competing accounting software product that allows extensive customization for automating processes.

Methodology

We studied dozens of the best accounting and invoicing software solutions to help small businesses find the right accounting software for their needs. As part of each analysis, we evaluated each program’s software features like payment and invoicing capabilities, integrations, mobile apps, report generation, supported user count and customer service options. We also assessed pricing and free trial availability and considered user reviews for independent opinions on each product’s pros and cons.

When determining the best accounting software for desktop users, we focused on options for small businesses that weren’t solely based in the cloud and still included everything that small business owners expect from modern accounting software.

FAQs

No, Sage 50 Accounting is not the same as Sage Business Cloud; they are two different products. Sage Business Cloud is no longer available for purchase in the United States. Sage 50 Accounting is now the company’s flagship small business accounting service in this market.

As a desktop-based solution, you will need to install the Sage 50 Accounting software onto your computer to access the program. However, the product’s hybrid nature and cloud backup means your data is always safely stored and accessible remotely.

Both Sage 50 Accounting and QuickBooks contain a robust set of accounting features geared toward small businesses. One difference is that QuickBooks offers more invoicing tools ― but at a higher price. Check out our detailed QuickBooks Online review to learn more.

Bottom Line

We recommend Sage 50 Accounting for …

- Business owners seeking old-fashioned desktop software with a one-time subscription payment.

- Businesses that want to retain the ability to do accounting work on a local device rather than in the cloud.

- Cost-conscious business owners who want to carefully track job expenses.

We don’t recommend Sage 50 Accounting for …

- Small business owners on a budget who need a basic, inexpensive accounting solution.

- Business owners who want to do a lot of their finance work on the go via mobile app.

- Accounting teams that prefer a sleek, modern UI.

business.com

Looking for more options?

Check out The Best Accounting and Invoice-Generating Software for 2024 business.com recommends.