MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Table of Contents

While owning a business can be rewarding on many levels, dealing with payroll taxes and their accompanying forms can be a pain. Depending on your employees and business type, you may need to work with many forms, and it’s crucial to handle them correctly.

The Internal Revenue Service (IRS) penalizes businesses for filing employment taxes incorrectly or failing to pay them. Fines vary by charge level, with federal offenses typically more expensive than state ones. In 2022 alone, the IRS collected more than $98 billion in unpaid assessments on returns with additional tax due.

We’ll highlight the payroll report forms business owners should know about and share tips on using payroll software to streamline the payroll tax process.

Editor’s note: Looking for the right payroll service for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What payroll tax forms do you need to know about?

Missing a payroll tax filing deadline or filing the wrong form can have expensive consequences. Here are the payroll report forms you should keep on your radar:

Form name | Due date(s) |

|---|---|

1. Form 941 | May 1, July 31, Oct. 31, Jan. 31 (2024) |

2. Form 944 | Jan. 31 |

3. Form 940 | Jan. 31 |

4. Form W-2 | Jan. 31 |

5. Form W-3 | Jan. 31 |

6. Form 1095-B | Jan. 31 |

7. Form 1094-B | Feb. 28 |

8. Form I-9 | Three days after the hire date |

9. Form W-9 | At the time contract work is ordered |

10. Form 1099-MISC | Jan. 31 to the recipient, March 1 if filed by paper, March 31 if filed electronically |

11. Form 1099-NEC | Jan. 31 |

12. Form W-4 | Feb. 15 |

13. Form 8027 | March 1 if filed by paper, March 31 if filed electronically |

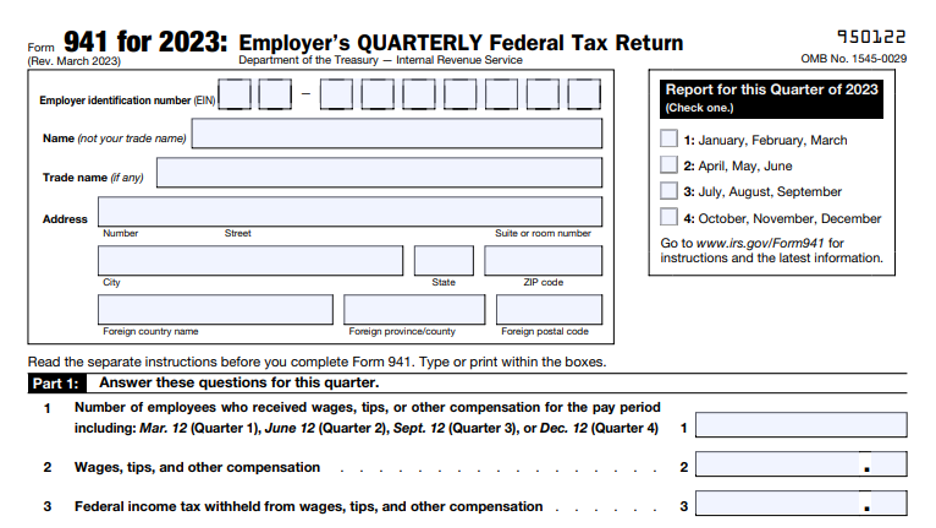

1. Form 941

Source: IRS

Form 941, the Employer’s Quarterly Federal Tax Return, reports the number of employees you have, their wages and taxable tips, and the federal income taxes you withheld. Social Security, Medicare taxes and sick pay are also documented here, along with any adjustments made. You must file this payroll tax form unless you have already submitted a final return, are a seasonal employer, or employ farm or household workers. A payroll form should be filed quarterly.

Due dates for 2023: May 1, July 31, Oct. 31, Jan. 31 (2024)

2. Form 944

Very small businesses sometimes use Form 944 instead of Form 941. This form is the Employer Annual Tax Return; the only businesses that qualify to use it are those with $1,000 or less in annual liabilities for Social Security, Medicare and federal income taxes. Additionally, you must have a written notification from the IRS permitting you to use this form instead of Form 941. This payroll tax form is submitted annually instead of quarterly, so if you’re qualified to use it, you should.

Due date: Jan. 31 (every year)

3. Form 940

Form 940 is the Employer’s Annual Federal Unemployment Tax Return. This payroll tax form is used to report the federal unemployment tax, or Federal Unemployment Tax Act (FUTA) tax. This tax funds unemployment compensation to employees who have recently lost their jobs. Your business must pay FUTA taxes if you paid at least $1,500 in wages in a quarter within the past two years. These taxes are paid quarterly but reported once per year.

Please note: Employers in California, Connecticut, Illinois, New York and the U.S. Virgin Islands are subject to higher FUTA taxes due to credit reduction.

Due date: Jan. 31

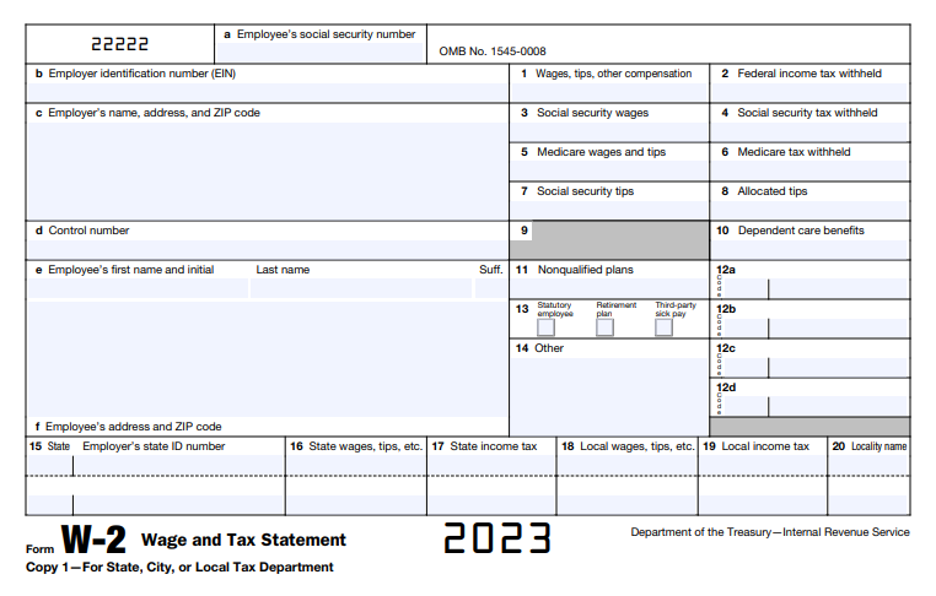

4. Form W-2

Source: IRS

The W-2 is one of the best-known tax forms and should be given to each employee at the end of each year. It reports each employee’s annual compensation and all federal, state and other payroll tax withholdings. This form does not need to be filled out for independent contractor workers; you’ll fill out Form 1099 for them instead.

In the 2022 tax year, the IRS raised W-2 penalty rates to adjust for inflation and increased the Social Security wage base from $142,800 to $147,000.

Due date: Jan. 31

5. Form W-3

The W-3 is a condensed version of your W-2 forms. For example, one W-3 can represent 10 W-2s. This form is called the Transmittal of Wage and Tax Statements. It includes total earnings, FICA wages, federal income wages, and the tax amount withheld. You do not need to give W-3s to your employees. Your W-3 should be sent to federal and state governments along with your W-2 forms.

Due date: Jan. 31

6. Form 1095-B

If you provide a health insurance plan for your employees that meets or exceeds what the Affordable Care Act (ACA) calls “minimum essential coverage,” file Form 1095-B. On it, you’ll note the type of health insurance, whether dependents are covered, and the coverage period for the prior year. Your employees will use this form to prove they have qualifying health insurance that exempts them from paying a penalty when they file their tax returns. If your business has at least 50 full-time employees and is what the ACA calls an “applicable large employer,” fill out Form 1095-C instead.

Due date: Jan. 31

7. Form 1094-B

Form 1094-B is the Transmittal of Health Coverage Information Returns, which is similar to the W-3 in that it summarizes Form 1095-B with the number of forms you’re submitting. It also gives the IRS your name and phone number to contact you if it has questions about the forms. You don’t have to send Form 1094-B to employees; submit it to the IRS along with the 1095-B forms. If your business is classified as an “applicable large employer,” fill out Form 1094-C instead.

Due date: Feb. 28

8. Form I-9

Form I-9 must be included in your onboarding package for new hires. The form confirms employee eligibility within the United States. Both U.S. citizens and noncitizens complete Form I-9 before receiving payment for their work. The employee attests authorization to work in the United States while providing documentation (like a birth certificate or driver’s license) to prove eligibility. Employers must review the documents and confirm that the papers appear genuine and are not falsified. The employer should keep Form I-9 on file in case of government review or if ICE serves your business with a Form I-9 audit.

The Department of Homeland Security’s U.S. Citizenship and Immigration Services (USCIS) states that the form must be submitted within three days of the employee’s hire date. For example, if the employee starts work on a Tuesday, the form must be submitted that Friday.

Please note: USCIS issued a new Form I-9 on Aug. 1, 2023. The new form revised the section outline to make it easier to complete. The previous form can be used until Oct. 31, 2023, after which employers may face noncompliance penalties.

Due date: Three days after the hire date

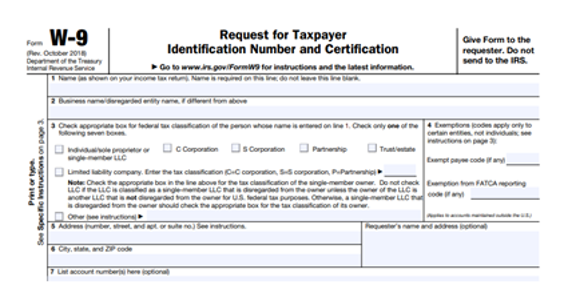

9. Form W-9

Source: IRS

Form W-9 is specifically for companies that hire independent contractors. If the company pays the independent contractor more than $600 in a tax year, the company must report those payments to the IRS using Form 1099-MISC. On Form W-9, the employer asks the contractor (or freelancer) for the tax filer’s name, address and tax identification number. Because the W-9 is not filed, the form has no specific due date. However, companies should request that the independent contractor complete the form before they are paid.

Due date: At the time contract work is ordered

10. Form 1099-MISC

Form 1099-MISC is used when you pay $600 or more to an individual or limited liability company. This includes attorney fees, awards, healthcare, royalties and rent. This does not include freelancers or contractors. There is a separate form for that.

The FATCA filing requirement checkbox can now be found on Box 13. Boxes 13-17 from the 2021 version of the form have been renumbered as 14-18 to accommodate this change.

Due date: Jan. 31 to the recipient, March 1 if filed by paper, March 31 if filed electronically

Form 1099-MISC is no longer used to report compensation given to freelancers and contractors. All non-employee-provided services should be reported on Form 1099-NEC.

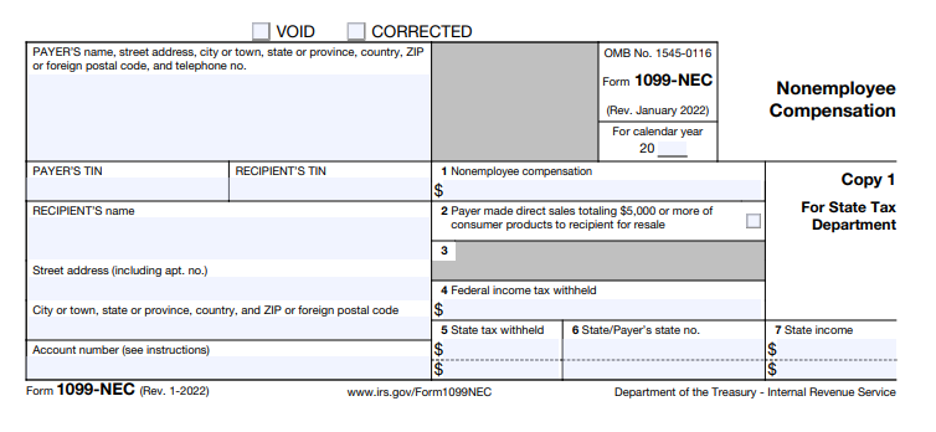

11. Form 1099-NEC

Source: IRS

Beginning with the 2020 tax year, the 1099-NEC is a simplified way to report over $600 paid to a self-employed individual, freelancer or contractor who supplied services to your business. The 1099-NEC covers fees, benefits, commissions, prizes, awards, etc., for non-employee-provided services.

From 2022 forward, the IRS released a continuous-use format version of Form 1099-NEC.

Due date: Jan. 31

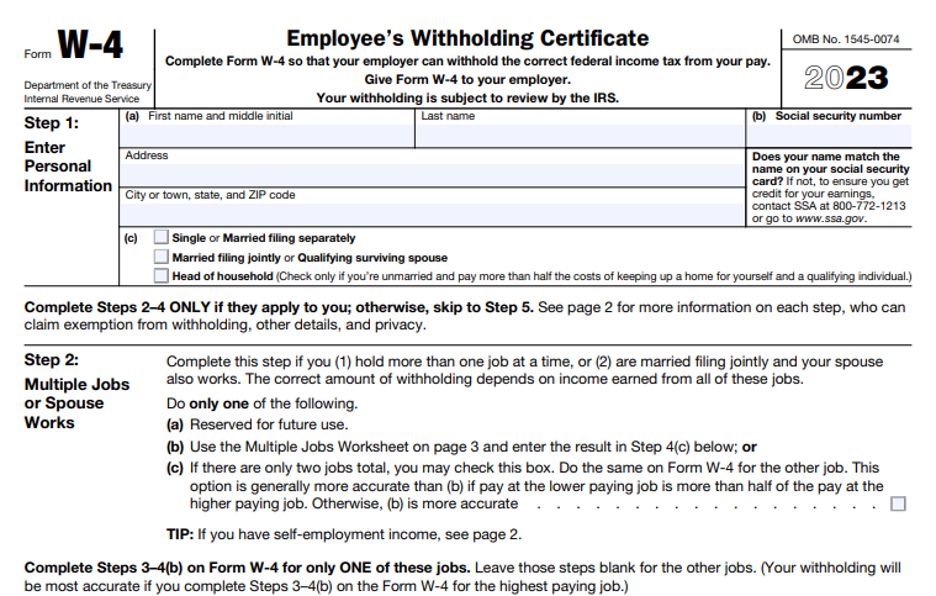

12. Form W-4

Source: IRS

Form W-4 must be provided to all new hires. Employees receiving the form should complete it before or on the first day of their new job. Form W-4 provides the employer with personalized tax withholding information that aids in maintaining an accurate payroll. Holding a W-4 for each employee streamlines the W-2 form preparation.

Employees who filled out a W4 before 2022 are not required to fill out a new W4 unless there is a qualifying event, like getting married or having a child.

Due date: Feb. 15

13. Form 8027

Form 8027 is not a standard form. It applies only to companies that employ more than 10 workers on a normal business day in industries where tipping is customary. Hospitality and food service companies are the most common industries that use Form 8027. It reports any tip income an employee received while working directly for the business. If the tip amounts are too low for the size of the business, the company may be required to pay out allocated tips. Form 8027 calculates this formula for any amounts due.

Due date: March 1 if filed by paper, March 31 if filed electronically

Payroll forms, pay stubs, W-4s and other forms should be kept for four years, according to the requirements for keeping paycheck records.

The best payroll software

Any process involving many manual calculations is susceptible to human error. Payroll software solves this problem with automated calculations, thereby freeing business owners to address other pressing matters.

Here’s a look at some of the best online payroll options for small businesses, to help you choose the right payroll software for your needs.

- ADP: ADP is an excellent online payroll platform with over 70 years of experience and a sterling brand reputation. Its robust software easily scales to accommodate large and small businesses. Take advantage of free or discounted employee assistance resources and legal services. Learn more in our in-depth review of ADP Payroll.

- OnPay: OnPay is notable for its transparent pricing, robust HR tools and multistate payroll processing capabilities. It also has excellent customer service and an easy-to-use interface. Read our detailed review of OnPay to learn more about its features and services.

- Paychex: Paychex serves small businesses and larger organizations with up to 1,000 employees. It provides an all-in-one employee retention program on higher tiers, including onboarding, training and employee benefits enrollment. Check out our complete Paychex review for more information.

Many top payroll vendors offer paperless payroll, instead providing digital tools for delivering pay stubs and tax forms.

Tips to avoid payroll mistakes

There’s no shame in asking for help. If you’re unsure how to set up payroll for your employees, or if you want to save yourself the trouble of navigating payroll regulations, sign up for a payroll service or hire an accountant. It’s better to pay for the service and have it done correctly than to pay fines for your mistakes.

Here are three tips to help you avoid common payroll mistakes:

- Pay attention to deadlines for tax payments and filing. Depending on your business, you may have payroll tax payments due annually or quarterly.

- Don’t miscalculate overtime. Some states have their own overtime regulations. In those cases, the regulation that gives the employee higher pay prevails. Check your state’s labor laws beforehand to ensure you pay your employees fairly.

- Set aside time for processing payroll. It’s important to allocate sufficient time to processing payroll. Late pay leads to unhappy workers, and rushing can cause costly mistakes. If you overpay or underpay your workers, you’ll have to take time to make corrections and may also face fines.

Payroll form FAQs

A payroll direct deposit authorization form allows employers to send money to employees’ bank accounts. Most employers ask employees to provide a voided check when completing the form, as it provides the ABA routing number that identifies the employee’s bank and account number. After the employee signs the form and returns it to the employer, their money can be sent directly to their account.

Banks typically use the Automated Clearing House to coordinate these payments. This solution is more secure and environmentally friendly than paper checks, and it removes the hassle of depositing a check or waiting for it in the mail.

Businesses with government contracts must submit a certified payroll form, also known as Form WH-347. When a payroll report is certified, it means employees have been paid according to the Davis-Bacon Act prevailing wage requirement. Certification includes a signed statement of approval that confirms the payroll forms are complete and correct.

A certified payroll report includes the names of every employee, the nature of the work, wages, hours worked, and amounts withheld. It’s typically due on the last day of the payroll period.

When you’re filing certified payroll forms, remember that every state has its own requirements and may ask for multiple forms and filings. Be careful not to overlook your state’s conditions.

Adding an employee to your payroll takes some prep work. Creating a payroll structure that works for your business and complying with federal and state labor laws streamline the process of adding new employees.

- Step 1: Obtain an employer identification number (EIN) from the IRS by submitting Form SS-4. You also may need to get state and local tax IDs.

- Step 2: Verify that your new employee is eligible to work in the U.S. Your employee must fill out the employment eligibility form, Form I-9, and an employee’s withholding certificate, better known as a W-4, to ensure you withhold the correct tax amounts from each paycheck.

- Step 3: Schedule pay periods and have compensation plans for holidays, vacations and other forms of leave.

- Step 4: Once you have the completed forms from your employee, add them to your payroll. If you use a payroll service, you must contact the company to add your new employee to your plan. Always report your payroll taxes to the IRS on time to avoid penalties.

Tip: To avoid payroll headaches, be aware of common payroll discrepancies, such as incorrectly adding employees to your system, misplacing payroll documents and incorrectly calculating employee absences.

Payroll status change forms and deduction forms accomplish different things, but you need both when hiring employees.

- Payroll status change form: As your business grows, you may have an employee whose status or position changes. This can affect their pay, whether they’re a full-time or part-time employee, their position or job title, and the department in which they work. It’s important to document these changes with a payroll status change form, which is then placed in the employee’s personnel file as part of their employment history.

- Payroll deduction forms: A payroll deduction form does just what its name suggests: It helps you determine and record how much money will be withheld from an employee’s pay. Some deductions, such as taxes, are mandatory. Others — like 401(k) plans, insurance plans, and union and uniform dues — are voluntary. Court-ordered payments, such as child support payments, may also be garnished from employee wages. This form gives your payroll provider the information it needs to withhold the proper amounts from your employees’ paychecks.

Julie Thompson contributed to this article.